Overlooked and Untapped Engine for Arizona’s Economic Future

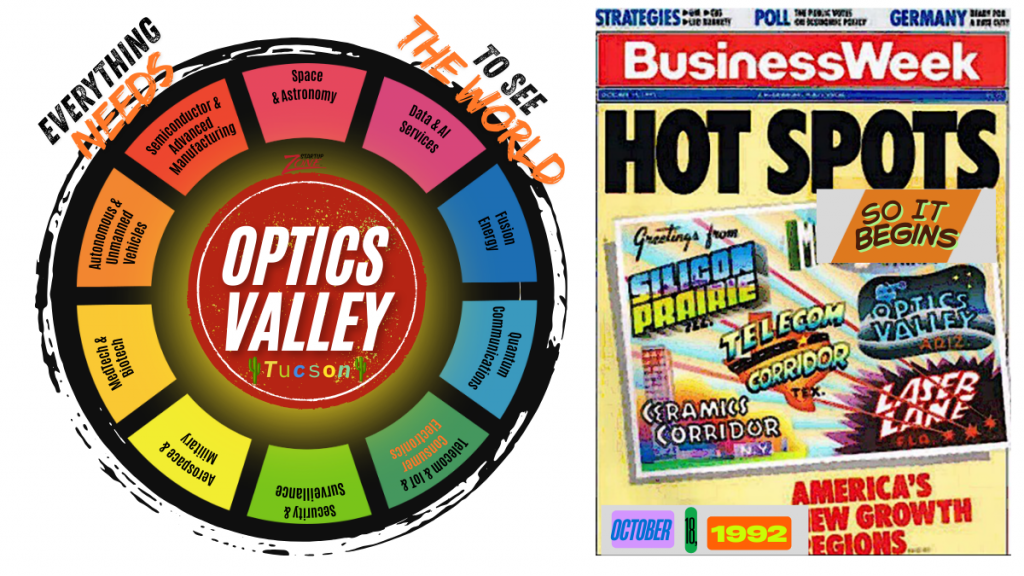

Optics Valley

Tucson was dubbed Optics Valley by BusinessWeek on October 18, 1992. Today, that is our brand globally. The economic impact of optics, photonics, and astronomy is reported as $4 billion for the state of Arizona. It is estimated that 100 to 300 companies related to the field have their home in Arizona. These companies are primarily small, generating revenue of well below $75 million. However, these technologies and innovations drive a $1T global market.

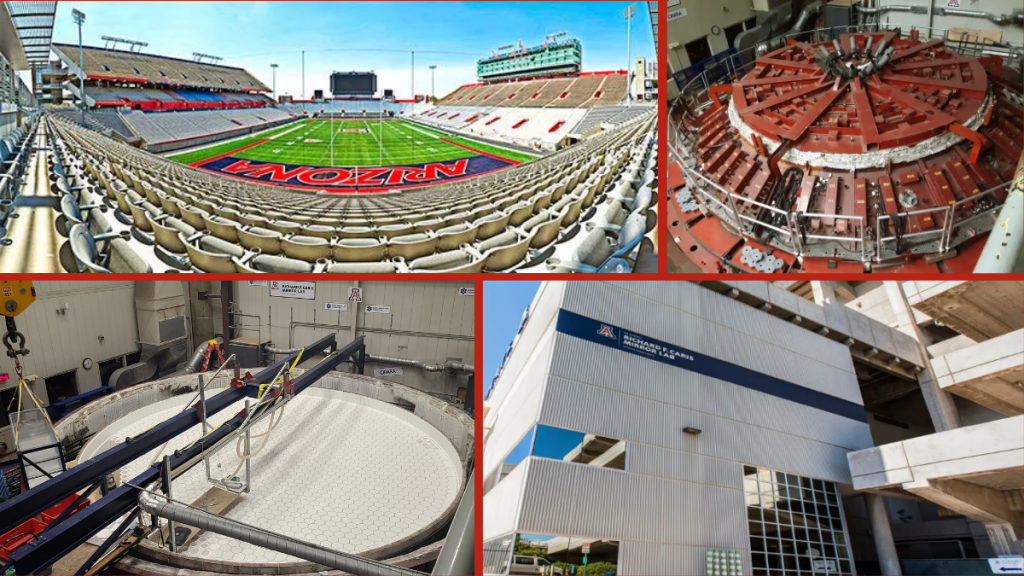

Widely recognized as the preeminent college for optics and photonics, the University of Arizona – Wyant College of Optical Sciences calls Optics Valley home. It’s the world’s largest and most comprehensive optics program, with over 150 undergraduate and 350 graduate students and 40+ faculty members. The program covers all major areas such as imaging, optical engineering, quantum optics, biophotonics, laser development, optical communications, and astronomical optics. It is the home to the Richard F. Caris Mirror Lab, which produces the world’s largest telescope mirrors. Alums hold leadership positions across the optics industry, national labs, and space science. Unfortunately, most are leaving Optics Valley for opportunities in Silicon Valley and other advanced technology hubs.

We must be more strategic in our approach to stem the brain drain and its impact on economic growth. Along with mitigating the scientific brain drain, we need to develop optics and photonics technicians to accelerate the implementation of the innovation. This is underway at Pima Community College.

Optics and photonics technologies enable vision in everything.

Estimates of Economic Impact

Although studies estimate that there is a $4 billion optics and photonics industry in Arizona, making up 0.8% of the state’s GDP, the reality is that it’s significantly bigger. This is because the $4 billion is a conservative, siloed view that doesn’t capture the embedded, cross-sectoral nature of the technologies. Optics and photonics are enabling technologies, integrated into countless products (e.g., phones, medical tools, defense systems), so their value often gets accounted for elsewhere (e.g., consumer electronics, aerospace, semiconductors).

This is a Sampling of the Applications

| Sector | Devices/Services | Optics/Photonics Components |

|---|---|---|

| Consumer Electronics | Smartphones, AR/VR headsets | CMOS sensors, waveguides, lasers |

| Laptops, Displays | OLED/microLED, backlights | |

| Cameras, Projectors | Projection optics, beam steering | |

| Medical Devices | Endoscopes, Microscopes | Lenses, fiber optics, illumination |

| Laser Surgical Tools | Excimer, Nd:YAG lasers | |

| Ophthalmic Instruments | OCT, wavefront optics | |

| Medical Imaging Systems | Spectroscopy, fluorescence optics | |

| Defense & Aerospace | Lidar, Rangefinders | Laser diodes, scanning mirrors |

| Night Vision Systems | IR sensors, optics | |

| Targeting Systems | Laser designators, adaptive optics | |

| Industrial & Manufacturing | Laser Cutting/Welding Machines | CO₂, fiber lasers, focusing lenses |

| Machine Vision Systems | Industrial cameras, optics | |

| 3D Printers (SLA, SLS) | High-precision lasers, optics | |

| Telecommunications | Fiber Optic Networks | Optical fibers, modulators, lasers |

| Transceivers & Optical Switches | MEMS optics, PICs | |

| Healthcare Services | Diagnostic Labs | Fluorescence, Raman imaging |

| Laser Surgery Centers | Surgical lasers | |

| Optometry Clinics | Wavefront diagnostic tools | |

| Manufacturing Services | Precision Metrology | Interferometry optics |

| Laser-based Manufacturing | Precision laser sources | |

| Nondestructive Testing | THz/optical imagers | |

| Telecom & Data Services | Fiber-optic Internet | Laser transceivers, fiber |

| Data Centers with Optical Interconnects | PICs, optical routers | |

| Security & Surveillance | Facial Recognition | IR cameras, waveguides |

| Lidar Surveillance | Lidar scanners, optics | |

| Scientific & Academic Services | Spectroscopy Systems | Gratings, filters, spectrometers |

| Microscopy, Astronomy Instruments | High-res optics, detectors |

Global Market Overview

The global optics and photonics market is vast and growing rapidly due to its foundational role across numerous sectors. Here’s a breakdown of the market size and growth by major segments as of 2024 estimates:

| Segment | 2024 Market Size | CAGR (2024–2030) | Notes |

| Global Photonics Market (overall) | ~$800 billion | ~7–9% | Encompasses lasers, sensors, optics, imaging, fiber optics, etc. |

| Optical Components (lenses, filters, mirrors, etc.) | ~$80–100 billion | ~6% | Includes both consumer and industrial use. |

| Lasers (industrial, medical, telecom, etc.) | ~$20–30 billion | ~8–10% | High growth in additive manufacturing and medicine. |

| Imaging and Sensors | ~$120 billion | ~9% | Driven by AI, autonomous vehicles, and health diagnostics. |

| Fiber Optic Communications | ~$15–20 billion | ~10–12% | Accelerated by 5G and cloud infrastructure. |

| Biophotonics | ~$65 billion | ~10% | Fueled by medical diagnostics, life sciences, and drug discovery. |

| Defense and Aerospace Optics | ~$25–35 billion | ~6–8% | Includes IR optics, lidar, and surveillance systems. |

| Semiconductor Photonics (PICs, lithography, etc.) | ~$50 billion | ~10–12% | Critical to AI and advanced computing. |

Summary

The optics-photonics-enabled industries will surpass $1 trillion globally by 2030, driven by transformative applications in AI, health tech, quantum computing, and clean energy. It is time to elevate our planning and execution to include Optics Valley as the catalyst for innovation and growth, not just for Tucson but for the state of Arizona.